A way to avoid this is by lightly touching some other keys on the keypad.įor more information about how to make your FNB eWallet safe, visit. The way this works is that your thermal signature is left behind when you press buttons, so criminals can use a smartphone with a FLIR ONE thermal imaging attachment to figure out your PIN. Allows for a file import to make payments. Saves time Instant recipient set-up, payments and maintenance, individual and bulk payments. Its mobile money service, eWallet, which allows customers to send money to anyone in South Africa. Enjoy access to great banking services ranging from investing, to prepaid products. FNB is well known for its innovative banking solutions. Experience the best in quality, usability, safety and ease of use to do your banking online, available 24/7. Saves money No monthly fees, reduces the costs incurred from cash payments. FNB Botswana, one digital bank, one unified look.

#Fnb ewallet pro#

Using a smartphone and thermal technology (an imaging attachment), criminals can easily steal your PIN. Benefits of eWallet Pro to Business Owners It's safe No cash handling, reduces cash on premises.

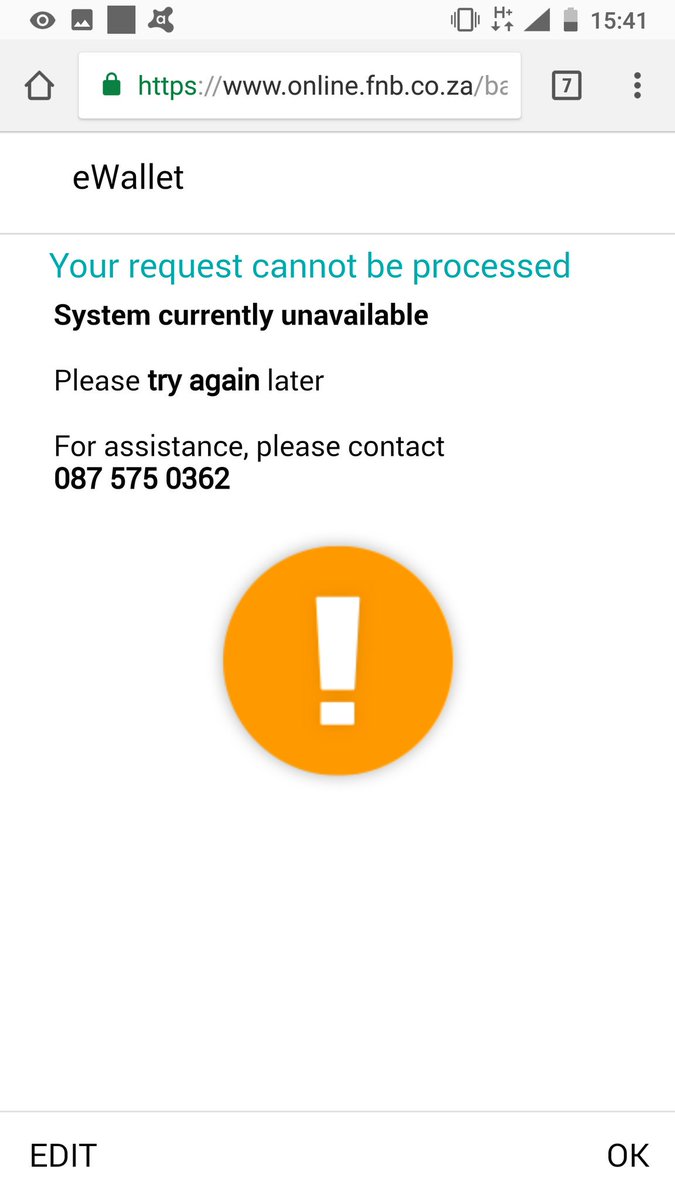

One of the ways that scammers are using to steal customer information at ATMs is through Thermal Technology. This is why it’s important for customers to be vigilant when using online banking as well as ATMs. Sending money with the FNB eWallet is very simple and your family/friend will get the much-needed. The popularity of the money transfer service makes it a potential target for scammers. The best and most cost-effective way to reverse FNB eWallet. Since its launch in 2009, more than 700 000 eWallets have been created, with 50 000 new eWallets created on a monthly basis. Customers should also keep their PINs safe before drawing the eWallet money. The temporary ATM PIN refers to the 5 digit One Time PIN that gives the recipient access to withdraw funds from the eWallet at FNB ATMs and FNB ATMs with Automated Deposits, without needing a bank card.įNB emphasises that it’s important to ensure that the correct cellphone number is used.

And up to R1,500.00 using Cellphone Banking or FNB ATMs. You can send an e-wallet of up to R3,000.00 per day when using the mobile app or online banking. There have been a few reported incidents of customers not receiving their PINs to be able to withdraw from an FNB ATM. The FNB eWallet enables clients to send money to a cellphone number (your wallet), and the money can be accessed instantly, at any FNB atm. You can use any of the channels to send money to anyone with a valid South African cellphone number.

0 kommentar(er)

0 kommentar(er)